When you are purchasing a home determining a property’s value is an essential step in the mortgage application process. You can help by providing precise and accurate information about your property to your Mortgage Professional.

How the current value of your home or property is assessed

The value of a property is determined by a number of different criteria, each of which can influence how much your home is currently worth. These criteria range from the square footage and the age of your home, to its location, construction quality, architectural features and even the number of bathrooms.

It is important to remember that a property valuation is not a fixed or permanent number. It is simply a snapshot of what your home is worth today, in relation to current market conditions and what other, similar properties are selling for. This value can change over time based on improvements to the property, as well as changes in your neighbourhood and the overall housing market.

Property valuation and mortgages

When applying for a mortgage, your Mortgage Professional will ask you a series of questions about your property. This information will help establish the property value, a critical element for determining the amount of your mortgage loan.

When you are buying a home, your mortgage application will include the purchase price along with a detailed description of the property. If you want to add the cost of any planned improvements to your mortgage application, be sure to provide all of your plans and cost estimates.

To help the process go as quickly and smoothly as possible, use the attached worksheet to identify and collect the information you will need to complete your mortgage application.

A professional appraisal

A professional appraisal may be required if a more in-depth assessment of the value of your property is needed.

This process includes a professional assessment of the property’s physical and functional characteristics, a detailed comparison of the home to recent comparable sales in nearby areas, and an assessment of current market conditions affecting the property. It is important to allow the appraiser access to the property in a timely manner, in order to minimize the time required to obtain financing.

From time to time, the property value assessment will not support the loan amount requested. Should this happen, talk to your Mortgage Professional, realtor or other members of your team of homebuying professionals to explore the options that are available to you.

Realtor description sheets – MLS Listing®

Purchase Agreement

Municipal property assessment – Former appraisal, if available

If applicable, identify planned or recent improvements in the Improvements to Property section below.

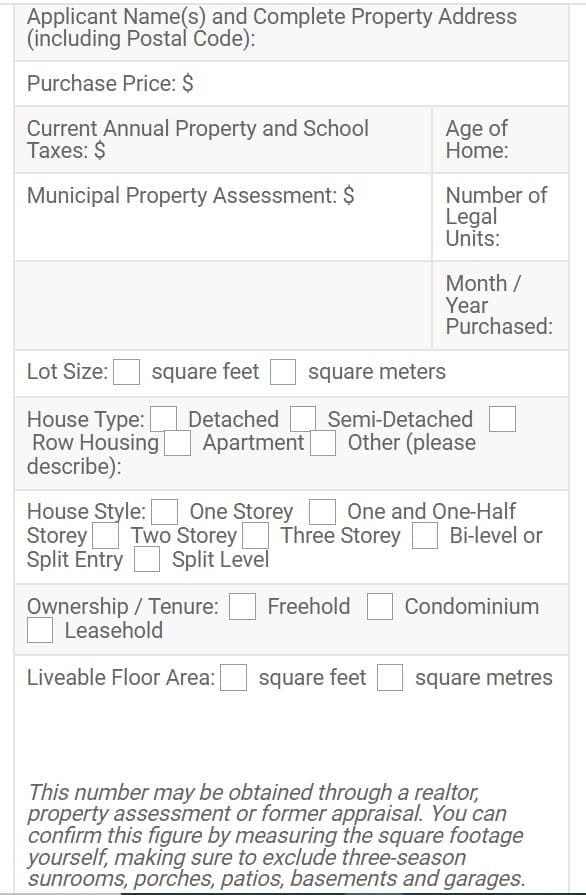

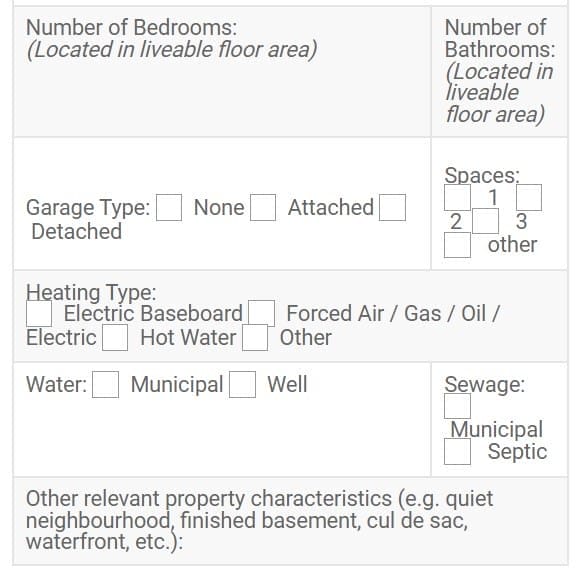

Property information worksheet

Your Mortgage Professional will require the following property-related information to complete your mortgage or refinance application.

If you are purchasing a property, simply provide your Mortgage Professional with the following documents where this information can be found:

For more details on CMHC’s programs, contact me or visit CMHC’s interactive “Step by Step” Guide. As Canada’s authority on housing, CMHC helps Canadians buy a home with a minimum down payment starting at 5%. Ask your mortgage professional about CMHC.

The information is provided by CMHC for general illustrative purposes only, and does not take into account the specific objectives, circumstances and individual needs of the reader. It does not provide advice, and should not be relied upon in that regard. The information is believed to be reliable, but its accuracy, completeness and currency cannot be guaranteed. Neither CMHC and its employees nor any other party identified in this Article (Lender, Broker, etc.) assumes any liability of any kind in connection with the information provided. CMHC stakeholders are permitted to distribute the materials at their expense. The above mentioned stakeholder organization is responsible for the distribution of this document.